September 25, 2009 – Semiconductor growth prospects for 2009 and beyond are slightly better thanks to improved demand for mobile phones and the impact of China’s stimulus package, among other factors, according to an analyst update from Gartner.

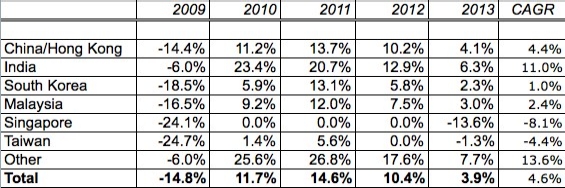

Asia-Pacific semiconductor revenues are now seen "less negative" than first thought back in 2Q09, when the firm projected a -21% decline; it now sees a -14.8% dropoff this year, with sales swinging from -10.7% in 2Q to nearly flat (-1.8%) in 3Q. Analyst Philip Koh attributes the turnaround to growth in worldwide mobile phone units (-12.1% in 2Q, -8.0% in 3Q) and short-term demand benefits from China’s government stimulus efforts. Though Koh says the 4Q09-1Q10 period will be "crucial" (isn’t it always?), he expects positive growth to return in 2010 and continue in low double-digits through 2012, before the next projected cyclical downturn in 2013.

|

|

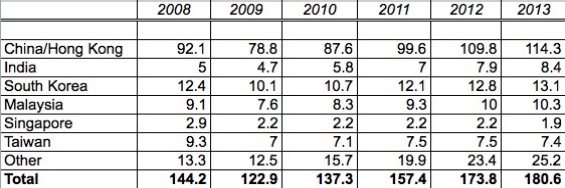

| Country-level semiconductor forecast, Asia/Pacific (US $B). (Source: Gartner) |

Two areas stand out in the chip sales estimates: India, and "Other" Asia-Pacific have CAGRs well above the average (11.0% and 13.6%, respectively). Emerging markets such as Vietnam are increasingly attracting business from global electronic equipment manufacturers and semiconductor vendors, Koh writes. Meanwhile, they’re also shifting to lower-cost destinations, which hurts traditional chip consumption strongholds like Taiwan and Singapore.

|

|

| Country-level semiconductor forecast, Asia/Pacific (% growth). (Source: Gartner) |