by Frank Bok Namgung, Philippe Cochet, Azores Corp.

Executive overview

This article discusses the various merits of steppers and scanners in photolithography for FPDs as relates to total cost of ownership. Due to technological advances and market trends, fabs must select the technology that will work best to meet their display and run sizes. Considerations include costs associated with capital equipment as well as mask costs.

Mobile products — in particular, mobile phones, personal data assistants (PDAs), digital cameras (still and video), portable media players, such as MP3s, and global positioning systems (GPSs) — continue to evolve from a design and technology standpoint to increase capabilities and improve usability. The environment is highly competitive and manufacturers are driven to capture and hold onto market share. The added features and escalating sales of "smartphones" are an example of a technology success story, even in the somewhat weakening global market of the mobile handset industry.

The latest industry research report from the Gartner Group expects total handset sales to decrease 4% in 2009, while sales of smartphones grow 13% to 36 million units. For 2010, the handset market is expected to recover slowly with 5%-6% growth, while the explosive uptake of smartphones is expected to continue.

How will this affect the display market? There will be greater demand for higher-resolution displays to support growing video and mobile internet usage. This was exemplified by increase in data plan revenue by mobile operators who provide iPhones, BlackBerrys, and other upper-end models with 3G and EDGE network features.

iSupplI Corp. predicts that the overall mobile phone market will decline 6% to 1.5 billion units during 2009, but this decline will be partially offset by sales of feature-packed smartphones to enthusiastic consumers. With the mobile handset market beginning its recovery in 2010, iSupplI estimates that smartphones will account for 29% of sales worldwide in 2012, compared with 14% in 2009. At that point, the mobile phone segment of the market will approach 1.75 billion units — which if true would suggest a phenomenal smart phone annual growth of 34.2% (CAGR) to 507.5 million units during the 2009-2012 timeframe.

DisplaySearch notes that the mobile phone market currently accounts for about 50% of the total small and medium display market, which means that the market for displays 10 inches and under will total approximately three billion units in 2009.

Today, the most popular smartphones incorporate QVGA displays, with screen sizes ranging from 3.0-3.5 inches. Taking into account GPSs, PDAs, digital and video cameras, portable media players, and just about all mobile phones, it’s assumed that 75% of some three billion units incorporate displays of 4.0 inches and less — in other words, about 2.25 billion mobile devices.

Small and medium displays are thus the market for photolithographic step-and-repeat machines (projection steppers), and the cost benefits of this technology over scanning projection aligners (scanners) is the subject of this paper.

Manufacturing of mobile displays

The following factors distinguish the design and manufacture of mobile displays. Though excess inventories are gradually being depleted, enabling new buildups, and only moderate erosion in pricing is expected, the global market and production methodologies are changing.

Intense competition is impacting market share and revenue for leading mobile display suppliers. Instead of adding new suppliers, however, phone makers are spreading orders among non-leading vendors. For example, while manufacturers in the past contracted with two or three vendors, in 2Q08 they employed an average of 5.7 display suppliers.

Taiwan-based Wintek Corp is now the leading supplier worldwide of mobile phone displays, displacing Samsung SDI of South Korea; Wintek increased its market share from 9.2% to 14.1% from 2Q07 to 2Q08.

Trends in the production of cell phone displays include the following:

— Average number of units produced per model: approximately one million. Minor changes may be made during the production run, where necessary and possible, as opposed to delaying the changes and incorporating them in a new model.

— Average lifecycle of models introduced to the market: about three months.

— "Best selling" products, such as the Apple iPhone and the Samsung Haptic are generally produced in quantities of 10-14 million units. (The Samsung Haptic, available in different models [Pop, 2, 8M, 8MP, etc.] is currently sold only in South Korea, and sold as "Instinct" in the US.) However, orders placed with individual suppliers tend not to exceed three million units, because of the use of multiple vendors.

— Those three million units will require between 10,000-20,000 photolithography plates, which today are produced by steppers on Generation 4.5 (Gen 4.5) glass sheets. The Azores 9200 is an example of a printer designed for Gen 4.5 (730mm × 920mm) applications (Figure 1).

|

| Figure 1. Azores Corporation 9200 PanelPrinter. |

— The numbers of layers are increasing in next-generation displays. Trans-reflective displays, for instance, require six or seven layers (including the organic reflective layer). Active matrix organic light-emitting diode (AMOLED) displays require more than 10 layers with higher resolution (1.0μm – 2.0μm) and further challenges for photolithographers can be expected. In fact, higher-end mobile phone makers, such as Nokia and LG Electronics, are beginning to base vendor selection on the ability to meet future needs for AMOLED display technologies that require 10-13 layers and resolutions of 1.5-2μm. Increased layers, of course, means higher mask costs.

For production of other types of small/medium displays for mobile products, trends encompass the following:

— An average of approximately one million units per model is produced.

— The average lifecycle of products can be short, with frequent changes at times being required. For example, suppliers in Korea release 5-7 new products a month; in China, 5-6; and in Taiwan, up to eight. With the numerous products and short runs, meeting the requirements of device manufacturers, especially in a competitive environment (price, delivery, etc.) can be challenging.

— Device manufacturers typically contract with a number of display suppliers in order to enable control over price and supply.

The Azores 9200 PanelPrinter uses Gen 4.5 glass plates for photolithography imaging in the fabrication of mobile displays. This appears to be the trend in the industry for advanced fabs, due to the flexibility and cost effectiveness of the process. Fabs need to be able to handle initial product orders that may be small (1000-5000 plates), because public acceptance is unknown. In addition, they should have the capability of producing 15,000 to 30,000 plates during a production run, in order to meet the volumes and lead times required by the larger display manufacturers.

|

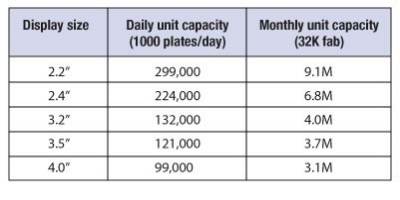

| Table 1. Comparison of daily and monthly plate production for various screen sizes. |

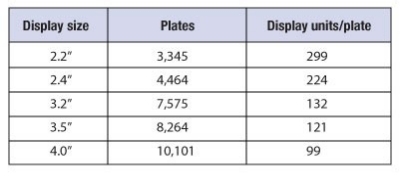

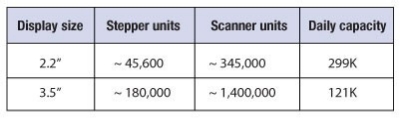

Table 1 depicts the daily manufacturing capacity for a typical fab of glass plates for mobile displays, based on screen size. Note that the data is relevant for a fab having a production capability of 32,000 glass plates per month. (The ability to produce the quantities specified in the table would not be possible for smaller fabs.) Table 2 indicates the number of plates needed to build one million units.

|

| Table 2. Plates needed for one million display units. |

Comparing the COO for steppers vs. scanners

Photolithography systems utilize two modalities for exposing the circuitry patterns on the FPD backplanes: step-and-repeat and scanning.

Step-and-repeat photolithography printers — aka steppers — images a substrate by exposing only a portion of the substrate at one time. Light from a mercury arc lamp is projected through a mask, or reticle, that contains circuit patterns. The mask is imaged through a projection lens to photoresist material deposited on the substrate. The substrate is then moved (or "stepped") to a second position to expose an adjacent area. Scanners use multiple lamps and larger masks, but as may be indicated by the name, continually move the substrate underneath the lens during exposure. While being able to more rapidly process large area substrates, scanners sacrifice resolution and overlay accuracy for maximum field size.

If both types of equipment are using Gen 4.5 plates with 3.5" displays, the scanner mask can hold 36 displays in one mask, while the stepper only holds four displays in one mask. The scanner can finish all plates with four exposures scanning of each mask. The stepper will need 36 exposures. In most scenarios, the scanner is 10%-20% faster than the stepper.

On first look, the comparison of stepper vs. scanner seems to heavily favor the scanner — yet more than 90% of the mobile display manufacturers worldwide use steppers instead of scanners. What are the reasons for this discrepancy? Apart from technical advantages that contribute to streamlining production processes and rapid changeover, there are significantly lower operating costs for steppers that make them ideal for typical small display production runs. While the scanner is faster, a scanner mask is larger and more expensive. Therefore, to be cost-effective, a scanner needs higher-volume production than commonly found in most FPD fabs.

|

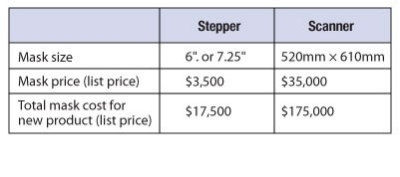

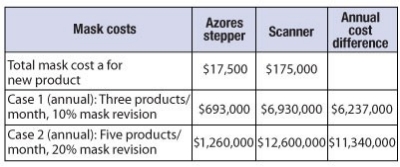

| Table 3. Stepper vs. scanner mask costs (five layer process, five masks). |

Table 3 provides a comparison of the mask costs for five layers in producing plates for a mobile display production run. The table provides typical stepper versus scanner mask costs. As can be seen, the mask cost for the stepper would total $17,500, while the mask cost for the scanner would be $175,000.

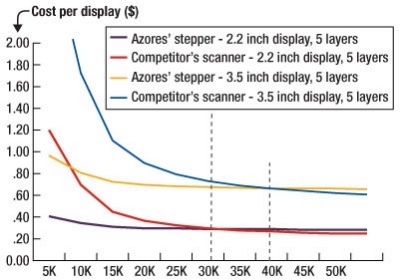

Figure 2 provides a basis for comparing the net costs, break-even points, and profits for a typical stepper, such as those manufactured by Azores Corp., vs. a standard scanner.

|

| Figure 2. Operating costs based on performance specifications from an Azores stepper and a standard scanner. |

Considering the savings in mask costs over the course of a typical year, the advantages steppers deliver are evident — no matter how aggressive the supplier’s sales activities. In addition, as the trend continues toward greater complexity with more layers per mask, scanner costs trend much higher.

Table 4 presents the difference in mask costs alone, on an annual basis, between the stepper and the scanner comparing two different sales scenarios.

|

| Table 4. Monthly mask costs for an Azores stepper and a standard scanner. |

Capital investment for fabs can range from $300M-$600M (and even higher) depending on the display technology, with the facilities being depreciated over four to seven years. Technologies include: thin-film-transistor liquid crystal displays (TFT-LCD), active matrix (AM), electroluminescent (EL) displays, low-temperature polysilicon (LTPS) LCDs, and organic light-emitting diode (OLED) displays. While TFT active matrix LCDs continue to dominate the industry for mobile devices, Samsung suggests that OLEDs could represent as much as half of the market for mobile displays within the next five years.

As Table 5 shows, in manufacturing 3.5" displays — the most popular screen size on the market — scanners can enable a display manufacturer to achieve profit with a minimum order of 180K mobile display units, while scanners will require an order of at least 1.4 million units.

|

| Table 5. Number of display units necessary to break-even on mask costs for an Azores stepper vs. a standard scanner. (Assumptions: Fab capacity 30K units/month, fab depreciation $100K/day; $1 profit/display; typical mask costs.) |

Conclusion

Flat-panel display manufacturers are being challenged by the worldwide economic downturn while at the same time needing to invest in their fabs to meet consumer demand for increasingly complex mobile devices. These factors, along with the competitive FPD market and dwindling inventories, do not allow manufacturers to remain idle for long.

While it’s a difficult time to make significant capital investments, most FPD manufacturers must analyze the true cost-of-ownership for their photolithography equipment.

Even when factoring the difference in capital costs, steppers meet the current needs of mobile display manufacturers with a significantly lower cost of ownership than scanners, both in terms of short production runs, as well as the longer runs required in the production of the more popular mobile devices.

Acknowledgments

PanelPrinter is a trademark of Azores. iPhone is a registered trademark of Apple Inc. Blackberry is a registered trademark of Research in Motion.

Biographies

Frank Bok Namgung received his BS from Seoul National U. and his Masters degree in physics from the Korea Advanced Institute of Science and Technology, and is the technical marketing manager at Azores Corp, 16 Jonspin Road, Wilmington, MA 01887 USA; ph. 978-253-6209; email: [email protected].

Philippe Cochet received his BS in electronics from the U. des Sciences et Techniques du Languedoc in Montpellier, France and is the director of Asian business development at Azores Corp.