November 2, 2009 – Yet more incoming signs that the chip industry is back on the recovery track: the SIA’s latest monthly data shows a big push in September, and the group says chip sales are on pace to beat its midyear forecast.

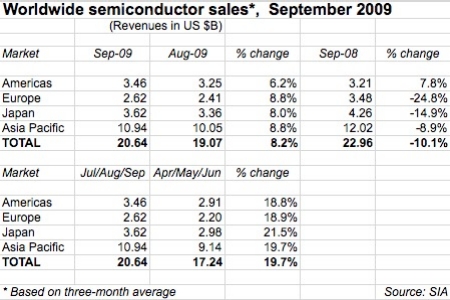

Global chip sales in September (a three-month average) totaled $20.64B, their first time cracking the $20B mark since Nov. 2008, representing growth of 8% vs. August, nearly 20% over the prior quarter, and -10% from a year ago. All regions continue to show Y/Y improvement, and the Americas actually came above water in this comparison period, up nearly 8%. Europe (-25%) and Japan (-15%) continue to trail the pack…but Europe did post the best three-month growth trend, jumping from 10% in Jun-Jul-Aug vs. Mar-Apr-May, to 19% in Jul-Aug-Sep vs. Apr-May-Jun.

The September growth also shows a return to historical norms as a buildup to holiday sales, noted SIA president George Scalise, in a statement. Sales of PCs and cell phones (the lion’s share of chip-using applications) also are running ahead of forecasts, and the industrial sector which had declined sharply also showed initial signs of recovery, he noted.

Things are looking well enough that Scalise said total-year sales are now expected to do better than the group’s midyear forecast. The WSTS "spring" forecast (issued in early summer) projected a -21.6% decline in global semiconductor sales, and a return to single-digit growth in 2010 (7.3%) and 2011 (8.9%). The SIA’s numbers, derived from the WSTS ones, forecast a -21.3% dropoff in 2009 to $195.6B, but more muted growth in 2010 (6.5%) and 2011 (6.5%).

So, let’s do the math. Year-to-date 2009 chip sales (Jan-Sep) totaled about $151.7B; from there, to arrive at SIA’s midyear forecast of $195.6B would require sales to skid to ~$14.6B/month, which seems very unlikely. Instead, given industry chatter about well-managed inventories and pent-up demand, let’s assume the current $20B level won’t change that much through year’s end (which historically they haven’t, given a slight bump and ebb). Then 2009’s annual sales (a three-month average remember, not actual) would tally roughly $211.7B — down about -15%, not -21%, from 2008’s $248.6B.

Of course, the key unknown still is what happens with holiday sales, and whether consumers express their renewed economic confidence by whisking electronics devices sell shelves or stay cautious and let gadgets sit gathering dust. The latter would mean starting another year of burning off leftover inventories.