December 22, 2009 – Preliminary rankings for 2009 worldwide semiconductor sales not surprisingly show a lot of declines, but not as much as had been feared as recently as just a couple of months ago — and some firms will even eke out positive growth by year’s end, according to data from Gartner.

The firm now projects an -11.4% decline in chip revenues to $226B in 2009, making it a historic two-down-years-in-a-row after 2008’s ~-4% dip — but that’s better than its late-August prediction of a -17% decline to $212B and well ahead of its early-midsummer outlook of $198B/-22.4%.

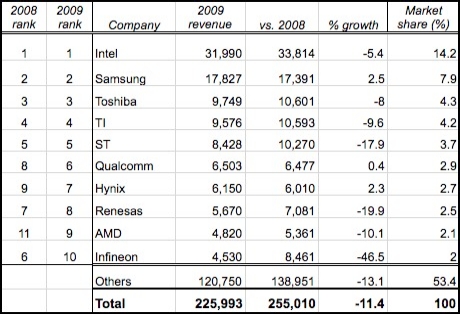

Among the top vendors (ranked by sales), only Samsung, Hynix, and Qualcomm are expected to eke out any growth in 2009, and just barely — the two Korean firms thanks to finally-firming memory prices, Qualcomm thanks to higher marketshare in cellular baseband processors, noted Gartner analyst Steve Ohr, in a report. (Outside the top 10, Taiwan’s MediaTek achieved double-digit growth [21.4%] thanks to its inroads in Chinese cellphone makers.) On the other end of the scale: Infineon (-46%, due to memory losses and sale of it wireless unit — even discarding that unit, still a -27% slide); Renesas (-20%) and STMicroelectronics (-18%) also saw chip sales sink more than the overall industry. Japanese companies in particular were hard-hit this year by the added weight of a strong Yen on top of the world recession, Ohr noted.

"With the market emerging from recession, semiconductor vendors need to track the end users’ spending patterns through 2010 in order to detect any disruptions in demand — or additional demands that outstrip capacity," Ohr advised. It’s also important to understand the timing of recovery in various sectors, which impacts different vendors, he noted. The PC segment was the first to spring back, followed later in the year by other segments reflecting consumer sentiment, like cell phones and automobiles. Enterprise spending was most deeply impacted by the recession and remains slow to recover."

|

| Top 10 worldwide semiconductor vendors, ranked by US $M of revenue. (Source: Gartner) |