January 25, 2010 – Despite reported warnings of inventory bloat at electronic distributors, nearly all segments of the chip supply chain remain lean, according to a report from iSuppli.

On the contrary, instead of a reputed increase in semiconductor inventories in 3Q09, inventory levels at distributors "are well below the historical average," notes iSuppli analyst Carlo Ciriello, in a statement.

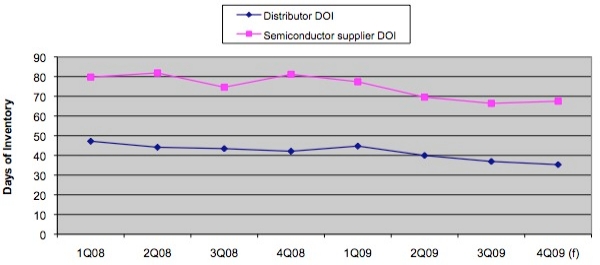

Distributors’ days-of-inventory (DOI) at the end of 3Q09 was actually down 15% from the same time a year ago; in dollar terms that equaled $4.8B worth of chips, which was down 22% from 3Q08. That distributor DOI was 17% less than the trailing three-year average, according to the firm.

Going forward, DOI is expected to have continued to decline in 4Q09 (to 18.7% below the three-year average), vs. a slight incline in inventory dollars. The decline in stockpiles parallels that among chipmakers, who saw their DOI shrink to 66.4 in 3Q09, down 11% from the same period a year ago.

| 1Q08 | 2Q08 | 3Q08 | 4Q08 | 1Q09 | 2Q09 | 3Q09 | 4Q09 (f) | |

| Distributor DOI | 47.2 | 44.1 | 43.4 | 42.1 | 44.7 | 39.9 | 36.9 | 35.3 |

| Semiconductor supplier DOI | 79.8 | 81.9 | 74.6 | 81.2 | 77.4 | 69.6 | 66.4 | 67.5 |

"Semiconductor suppliers have been maintaining tight control over inventories," preferring just-in-time fulfillment instead of "capital-constraining shelf stocking," according to Ciriello. "This has resulted in lower inventories throughout the electronics supply chain, including at distributors."

Chip inventories are at low levels for most other segments of the electronics supply chain as well, according to iSuppli — makers of PCs, storage devices including hard-disk drives, and cell phones also saw semiconductor DOI in 4Q09 lower than historical levels. Any increase in demand for those end products likely will translate directly into new chip sales. (iSuppli noted comments about inventories during Intel’s recent quarterly results conference call, citing "much stronger sell-through and lower year-over-year inventory levels," as well as an internal "healthy level of inventory" relative to demand.)

The recovery of the chip industry in 2H09 can be directly attributed to just this "deft management of semiconductor inventories," iSuppli notes. And as demand recovers, these lean inventory levels will continue to drive the market’s return to growth in 2010: 15.4% growth in revenues, vs. a -12.4% decline in 2009, the firm predicts.

|

| Quarterly DOI among distributors and semiconductor suppliers, 2008-2009. (Source: iSuppli) |