by Michell Prunty, senior consumer analyst, Semico Research Corp.

January 25, 2010 – 2009 is being pegged as the year of the e-reader, bringing paper at last to the digital age. Though slow to be adopted, new technology, ease of use and access to content ensures that this product will have high growth rates in the coming years.

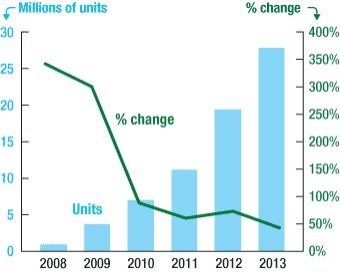

In 2008, e-reader shipments were less than a million units. Semico forecasts sales to grow to almost 30 million units by 2013 with a CAGR of 98.6%. The figure below shows actual shipments for 2008 and forecast unit shipments for 2009 through 2013.

|

| Figure 1. Worldwide e-reader unit shipments. (Source: Semico Research Corp.) |

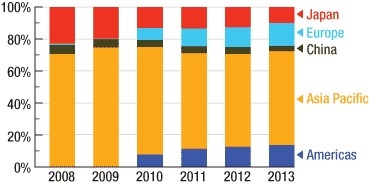

With the majority of e-readers being produced in the Asia-Pacific, the majority of semiconductor revenues are also from that region, though most consumption takes place in the Americas. Throughout the forecast period, the Asia-Pacific will have the largest percentage of revenue, though the Americas and Europe will gain market share with new entrants. Manufacturing done in Japan will move toward the Asia-Pacific, while new manufacturing will start up in the Americas and Europe.

|

| Figure 2. E-reader market share by region. |

The earliest e-readers were created in the late ’90s, during a decade of new innovations throughout the handheld market. E-readers offered between 4MB and 16MB of NAND Flash, enough to hold between 10 and 40 e-books. The screens were backlit black & white LCD with some e-readers providing touch screens. To download e-books most devices had to connect to a PC, though a few had a built-in modem. The battery charge lasted about 24 hours.

In 2004, the first popular e-reader was introduced in Japan called the Sony Librie. It was the first e-reader with an electronic paper display (EPD). When e-readers adopted EPDs, the battery life benchmark changed due to the nature of the new screens — EPDs only use batteries when a new page is loaded, instead of LCD screens which constantly use power. As a result, e-readers no longer benchmark their battery life by the number of hours between charges, but by the number of page loads between charging. The battery life for the Librie was about 10,000 pages.

During these years for the developing e-reader market, consumers became accustomed to carrying a cell phone, and an MP3 player, and at times a portable multimedia player (PMP). Only after becoming more accustomed to versatile handheld products were they willing to look into the e-reader market.

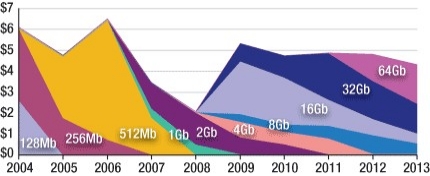

It wasn’t until Amazon’s Kindle, released in 2007, that the e-reader finally began to enter the mainstream consumer market. Part of what drew consumers to the Kindle was the ability to immediately download and begin reading e-books anytime, anywhere. Before the Kindle this was nearly impossible. Whispernet, available from Sprint, was another e-ink device that included an EVDO connection, eliminating the need for a PC to download books, though a USB connection was still included. The Kindle had 256MB built-in NAND with an expandable memory slot.

The following figure shows e-reader NAND semiconductor revenue per device.

|

| Figure 3. E-reader NAND revenue in US $M. (Source: Semico Research Corp.) |

The next steps for e-readers

The e-reader is no longer a niche product, and has stopped catering to early adopters. The next hurdle for increased consumer acceptance is the price. Currently, the average price hovers around US $300, high enough to turn away many consumers because other types of handheld devices can also read e-books for a much lower price. Penetration rates will dramatically increase once $99 e-readers are introduced.

E-readers on the market today have a screen size between 5" and 11", though this is not a method of identification and may change. Most e-readers aim to mimic the size of a hard cover book or a magazine. The evolution of the e-reader is centered around the e-book content. The main concern for users is having an easy-to-use method of downloading e-books quickly, which is why the Kindle is so popular.

What makes the e-reader device different from other handhelds on the market is its screen, which offers low power consumption and is easy to read in the daylight. E-readers will not be taking market share from other devices — on the contrary, many users will opt to download books onto their small phone or netbook to eliminate the need to buy or carry another device.

E-readers may be subsidized, and usually come with no monthly fee to browse the Web or download e-books, although some devices may limit browsing capabilities and may charge for "shipping" an e-book. While profit margins on e-readers may be low (similar to the gaming market), many manufacturers such as Amazon and Barnes & Noble are banking on revenues from e-book sales as the real benefit. The potential profit in content distribution is much larger than the potential profit of the actual devices.

Future e-readers will include color touch screens and be similar to netbooks, though this is reliant upon the screen technology and how quickly innovations in that market occur.

Breakdown of e-reader technologies

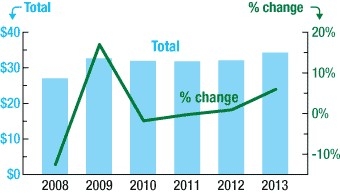

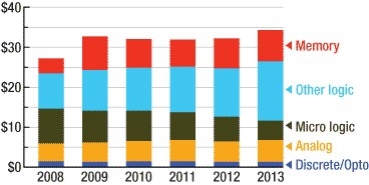

The total semiconductor content value for a typical E-reader in 2013 will be 1.2% higher than in 2009. Note decreases in semiconductor content in 2008, 2010, and 2011. These increases and decreases are due to new entrants to the market and the different features they exhibit.

|

| Figure 4. E-reader semiconductor content. (Source: Semico Research Corp.) |

The cost of memory will stay almost constant due to an increase in built-in memory over the years, as well as the sale of SSD cards along with the e-reader. The figure below shows the cost breakout of semiconductor content. (Semico follows SIA category definitions.)

|

| Figure 5. E-reader semiconductor content in US $. (Source: Semico Research Corp.) |

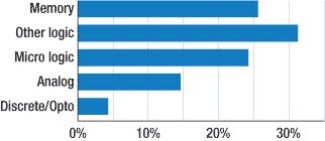

As shown in the following chart, "other logic" has the highest percentage in the semiconductor cost in e-readers for 2009, mostly due to the screen controller. Memory is the next highest percentage, with 25.6% of the total cost. Semico includes a percentage of secondary memory that would be bought along with the e-reader.

|

| Figure 6. 2009 E-reader content by major semiconductor category. (Source: Semico Research Corp.) |

Michell Prunty is senior consumer analyst at Semico Research Corp., ; ph 602-997-0337, e-mail [email protected]. For more information on e-readers, Semico offers a free abridged version of an in-depth e-reader report at www.semico.com. To obtain a copy, please contact Sam Caldwell at [email protected] or 602-214-9697.