March 29, 2010 – Mapping much of the semiconductor equipment sector along two sets of data reveals that there might be conditions brewing that could create "the catalyst, finally, for consolidation in the equipment space," according to Barclays analyst CJ Muse.

To be sure there have been a number of M&A moves in the past year or so: Applied Materials/Semitool, Asyst/Peer Group/Crossing Automation, Semilab/SDI, FormFactor/Electroglas, Oerlikon-ESEC/BE Semiconductor, and in recent days Jordan Valley/Metrosol and Tegal/OEM Group, just to name a few.

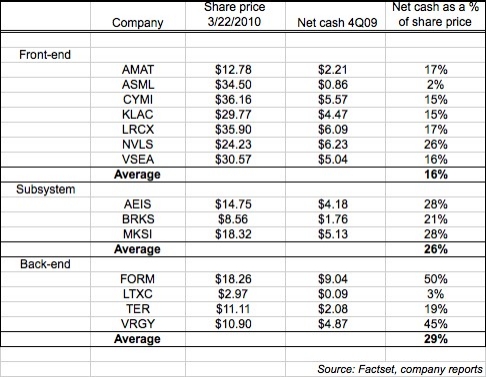

Industry winds seem to be building, as demand continues to be heavy and is expected to stay brisk probably through year’s end and into 2011. And companies are starting to build up cash again as cost-cutting efforts are realized, tool shipments improve, and profit needles swing back to black. From an investment perspective, Muse postulates that cash-flow generation as a percentage of share prices reveals that many companies in the semiconductor equipment space have done a very good job of revitalizing their business models at given revenue levels than in previous cycles, particularly among backend and subsystems suppliers. The average cash/share price is now 29%, and could rise across the board by 500 basis points in 2010 (e.g., 16% to 21% for front-end process equipment firms), and another 700-1100 basis points exiting 2011, Muse notes. And companies aren’t getting enough credit for their operational improvements, he notes, as industry watchers celebrate order momentum instead.

The result? With ~80% capex growth predicted for 2010 and another 15%-20% expected in 2011, sales and cash generation should rise accordingly, assuming no new buyback programs and substantially increased cost structures. And thus, valuations should start glowing both from price/earnings as well as "enterprise value"/normalized sales. Many firms are currently trading at ≤1.0x levels, he points out — and given that normalized sales are based on mid-cycle (not peak) wafer-fab equipment (WFE) levels, such multiples are "highly attractive," Muse points out.

The upshot of Muse’s research: Investors should take a more serious consideration of order strength and valuation and rally the sector stocks. If they don’t, and these ratios continue to become more and more attractive, "look for this to be the catalyst, finally, for consolidation in the equipment space," he writes.