April 23, 2010 – Semiconductor equipment suppliers reported continued moderate growth that’s increasingly back in line with pre-downturn levels, according to the latest monthly data from SEMI.

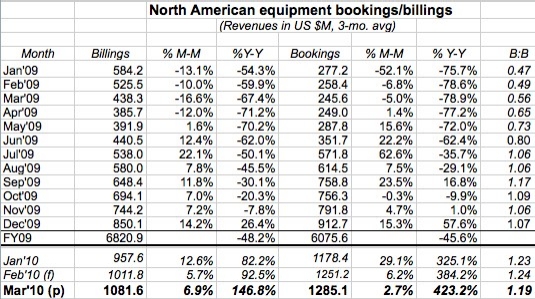

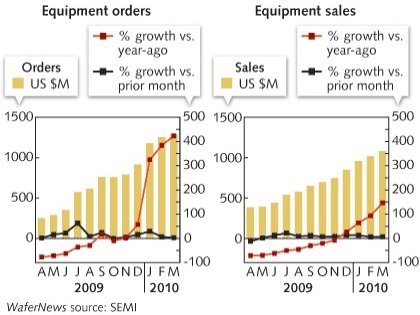

North America-based semiconductor equipment suppliers reported $1.29B in orders during March 2010 (a three-month average), up 2.7% from February, and sales of $1.08B (up 6.4%), showing continued moderate growth and coming back in line with pre-downturn levels, according to the latest monthly data from SEMI. (Year-on-year comparisons are once again eye-popping — 423% bookings, 147% sales — since this time in 2009 was the deepest depths of the slowdown.) The book-to-bill ratio (B:B) of 1.19 means $119 worth of orders were received for every $100 shipped during the month.

For its final February numbers, SEMI tacked on an extra $20M, bringing M/M growth up to 6.2% (vs. 4.5%); an extra $5M in billings inched up M/M growth to 6.1%.

Summarizing the numbers and trends:

- Bookings are at their highest levels since Aug. 2007. And SEMI has added a final $20M-$50M to its preliminary tallies for the past three months.

- Billings are also on a roll, now at their highest level since June 2008.

- The B:B has stayed above the 1.0 parity mark for nine straight months, meaning more business continues to come in (orders) vs. go out (sales).

- Bookings have increased sequentially in 11 of the past 12 months (with the only slide a -0.3% dip in Oct. 2009). For billings, the streak is 11 in a row dating to May 2009.

"The steady and consistent rise in bookings and billings shows that the industry is on a well-managed growth path," stated SEMI president/CEO Stanley Myers.

In Japan — where March designates the fiscal year-end for many firms, and thus a final push in business — the news is even better. Japan-based manufacturers of semiconductor equipment posted ¥97.18B (US $1.045B) in orders, up nearly 13% sequentially and an unbelievable 617% from a year ago, according to the Semiconductor Equipment Association of Japan (SEAJ). Billings of ¥83.31B ($894.7M) were up nearly 30% M/M and 87% Y/Y. The B:B fell slightly but is still well above parity at 1.17, meaning $117 worth of orders is coming in for every $100 in sales billed for the month.