by Michael A. Fury, Techcet Group

January 11, 2011 – With a roster of 115 attendees, the 2011 Industry Strategy Symposium kicked off at the Ritz-Carlton, Half Moon Bay, CA under sunny skies with calm seas.

The conference keynote address was delivered by Mark Durcan, president/COO of Micron Technology. One-third of Micron’s revenue comes from three JVs in DRAM and NAND and a third of total R&D spending comes from the JVs, but they represent ~55% of the total manufacturing capacity. Micron claims a higher than industry average efficiency in capex and R&D spending. The company is targeting 2014 as the introduction date for a DRAM alternative, which must meet a 30% cost reduction over current standards. The acquisition of Numonyx complements Micron’s internal efforts in PCM. Micron’s revenue from personal computing products is down to 27% (it used to be 99%) thanks to a strategic push for market diversification. Revenue is derived 70% from sales in Asia, 21% in US, 9% in Europe. R&D efforts are expanding into digital projection, LED and solar technologies. The company’s successful trajectory has been built around judicious but aggressive M&A activity and conservative cash management.

Opening the discussion of economic trends, Bruce Kasman, chief economist of JP Morgan, predicted growth but with neither health nor balance. Performance in the US will be dominated by policy decisions made in China and, to a lesser degree, in Europe. Given the depth and duration of the latest depression with 10% unemployment, he foresees that it will take until 2017 for US unemployment to return to 6%. Increasing oil prices are currently being driven by demand rather than supply-side constraints, which is a good growth indicator. Reasons for global optimism are primarily faith-based — you have to believe. The data are not making that easy.

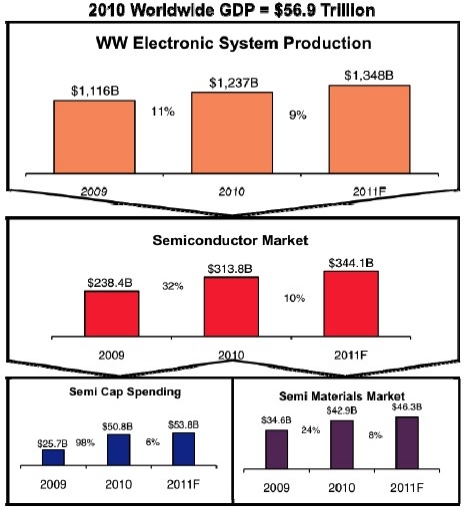

Bill McClean of IC Insights zeroed in on the outlook for semiconductors and related markets. Bill is currently coming in with the most optimistic semiconductor forecast with 10% growth for 2011, 11% for 2012. PC unit shipments continued to grow right through the 2009 downturn. 2010 gave us the largest y/y revenue increase on record, $75B; one third of that, $25B was turned back for CapEx. Over the past decade, good chips shipped per wafer has increased <1%/year; wafer starts are the sole lever for chip volumes. Industry cyclicality will track better to global GDP as consumer products increase their semiconductor content, and less to corporate IT buying cycles.

|

| Electronic industry interdependence. (Source: IC Insights) |

Handel Jones of IBS offered a measured amount of cautious optimism: 7.4% IC growth for 2011, led by wireless communications. Revenue is going up because of the increased software content of products, which improves margins since software is not capital-intensive, he said. The TSV market will be driven by memory and by processors with embedded memory, with these two comprising ~50% of total TSV usage. Beyond 22/20nm, the global demand for high-end servers will be satisfied by <20k wafers/month. The present upswing notwithstanding, he foresees an IC downturn in 2013.

Jim Feldhan of Semico Research cautioned that we may be heading toward a danger zone. Since 1960, every year of IC growth >30% was followed by a year of growth <10% or negative. 2010 was 33%; Semico is forecasting 8% in 2011 and 3.8% in 2012. China is already the world’s 2nd largest economy, and will be 1st in five years.

Offering another macroeconomic perspective, Robert Fry, chief economist at DuPont, pointed out that every country in Asia except Japan has recovered above its pre-recession high, but the US is still lagging due primarily to sluggish hiring and weak housing markets. 2009-2011 marks the first period of more that four consecutive quarters of fewer than 1 million US housing starts. Pent-up demand for car sales could drive a sharp rise in both consumer spending and employment. His forecast for 2011 global GDP is 3.4%, led by China (9.2%), with the US at 3.2%. Crude oil and gasoline prices were a significant contributor to the 2009 recession, often overlooked due to the publicity around the mortgage and banking collapse. The present economic slowing is more likely to lead to a reacceleration of growth, rather than a double-dip.

Dean Freeman, VP of research at Gartner Dataquest, explained how the industry is at an inflection point — applications are now driving technology development & growth, whereas in the past technology enabled applications which followed. (Witness the large number of new tablet PCs introduced at CES this year.) Other areas of transition: NAND will surpass DRAM spending in 2012; capacity in 150mm and 200mm wafers will remain steady for the next several years, rather than tailing off, as both analog technologies and trailing edge IDM designs move into foundries; and capital spending will shift to foundry and NAND, though flat for 2011 and up 12% for 2012.

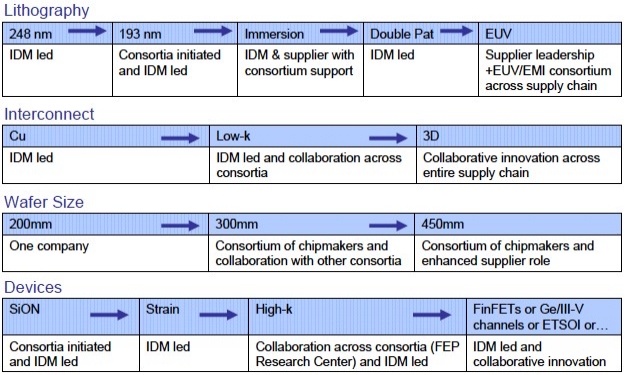

Solving the manufacturing and technology development challenges of future semiconductor devices will require more robust collaboration models, said Dan Armbrust, CEO of SEMATECH. Critical areas are lithography, interconnect, wafer-size transition to 450mm, and new device structures and materials — and as the number of players at these advanced nodes continues to shrink, it is likely that the number of equipment and metrology suppliers for key process steps will collapse to one each, particularly in lithography-related areas. 3D interconnect is the only way to support bandwidths >12.8Gb/s, with 2013 as the benchmark year for volume production. Industry alignment and consensus timetable for 450mm transition will be established in 2011, with 2016 the outlook for fab implementation.

|

| Major manufacturing technology transitions. (Source: SEMATECH) |

Björn Ekelund, head of ecosystems and research for ST Ericsson, presented his perspective on the coming smart phone disruption. Phone sales overall outnumber births globally by 9:1, and with electronic devices increasingly communicating with each other at many levels means that the human population of 7B does not constitute an upper limit for mobile communication sales. Every minute of every day, 35 hours of new content is uploaded to YouTube, much of it from mobile devices. Smart phones are electronically closely related to tablet computers. However, for both, the processor is designed for an Internet paradigm, whereas the radio modem is designed for a telecom paradigm, causing the two modules to become more segregated rather than integrated. Modem processing needs have grown 10× faster than Moore’s law over the past 15 years.

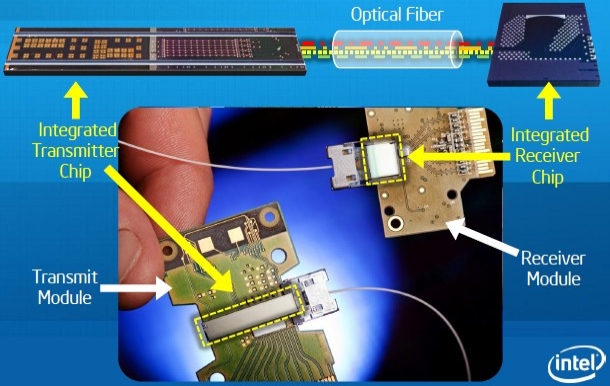

Bridging photonics to computing was the topic of Mario Paniccia, Intel’s director of photonics, emphasizing just how much data there is to move (it’s a lot). A single MRI image set can contain up to 1 petabyte (103 terabytes or 1015 bytes) of data. The LHC (large hadron collider) generates 12 exabytes (106TB) of data per year. We can expect to have 15B devices connected globally by 2015, all exchanging data. (OK, I’m convinced.) By multiplexing four InP on Si hybrid lasers at 12.5Gbps each, Intel has demonstrated a 50Gbps data transmission rate. The receiver is four Ge-on-Si photodetectors operating on the de-multiplexed optical channels. The reliability test detected no errors in more than 1 petabit of data, for a bit error rate of 3×10-15. For calibration, at 50Gbps you could download a full length HD movie in one second. At 1Tbps, you could download 2-3 entire seasons of an HDTV show in one second, or the entire Library of Congress in 1.5 minutes. (But if you spend your time watching HDTV, when would you ever read it?)

|

| The 50G integrated silicon photonics link: Transmitting and receiving light with silicon. (Source: Intel) |

Michael A. Fury, Ph.D, is senior technology analyst at Techcet Group, LLC, P.O. Box 29, Del Mar, CA 92014; e-mail [email protected].