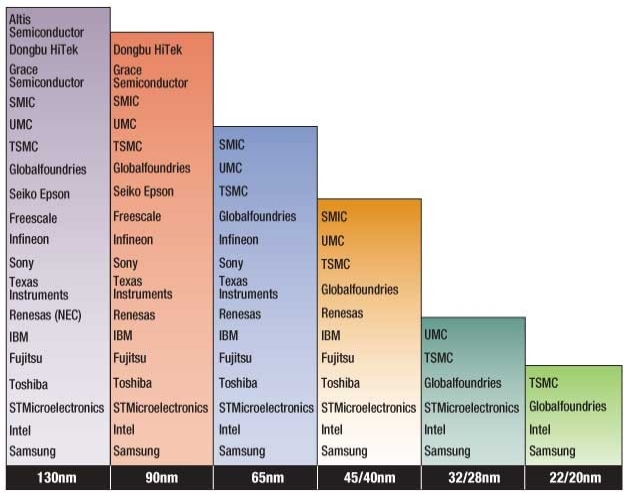

January 27, 2011 – By the end of 2011 there may be only three leading-edge high-volume foundries — TSMC, GlobalFoundries, and Samsung — able and willing to push the leading edge of CMOS through the 32nm and to 22nm and beyond, says IHS iSuppli.

"The enormous cost of advanced semiconductor process technology is whittling down the ranks of leading-edge foundries," said Len Jelinek, director and chief analyst of semiconductor manufacturing at IHS, in a statement.

Who’s the eventual winner among leading-edge foundries? The clear favorite is TSMC, which commands 50% market share and the most capacity (though a chunk of its business is at trailing-edge, while GlobalFoundries is going all-in at the leading edge.) TSMC has an empty shell just waiting for equipment once demand picks up. In fact, if TSMC sells directly to the merchant market it would eclipse Intel as the largest semiconductor supplier, Jelinek notes.

That achievement is something Samsung says it wants to be, though. In order for the Korean giant to pass Intel (and avoid TSMC), it’ll have to be "more aggressive in both memory manufacturing and in the foundry business," he says.

Intel may offer some foundry services to fabless suppliers working its Atom processor into their designs — in fact it’s already offering a 22nm peek to FPGA designer Achronix. But while scaling up a foundry business within Intel could generate revenue and improve asset utilization, it goes heavily against the company’s traditional philosophy, he points out.

All four of these companies (TSMC, GlobalFoundries, Samsung, Intel) are expected to outperform all other foundries in 2011, wielding the technology, capacity, and money to keep their leadership positions.

Missing from the foundry discussion is Japan, which is likely to have zero CMOS suppliers manufacturing at or beyond the 32nm node. Domestic equipment suppliers (with help from funding) could break out in 2011 and pursue foundry opportunities, Jelinek suggests. The alternative is far less pleasant: "the Japanese semiconductor industry could suffer greatly if it chooses to remain in the sidelines."

|

| Major semiconductor suppliers’ advanced CMOS logic manufacturing technology capability in 2011. (Source: IHS iSuppli) |