February 4, 2011 — Apple’s iPad and the Android-based tablets, along with other media tablets, make up the fastest growing microelectromechanical system (MEMS) sector in the consumer electronics and mobile segments, says IHS iSuppi researcher Jérémie Bouchaud. MEMS sales for tablet use is predicted to increase nearly 400% YOY. Cell phones remain the largest sector for MEMS adoption, however.

|

Sales of MEMS for use in tablets will rise to $140.4 million this year, up 373% from a mere $29.7 million in 2010. By 2014, tablets will become the second-largest application for MEMS sensors in the consumer and mobile space after cell phones, with revenue of $280 million.

"With their focus on providing compelling user interfaces, tablets are emerging as a major growth area for MEMS," said Jérémie Bouchaud, principal analyst for MEMS and sensors at IHS. "MEMS accelerometers and gyroscopes play a key role in tablets, utilized not only for automatic screen rotation and tilt compensation for the compass but also for motion-based user interfaces. MEMS filters such as bulk acoustic wave duplexers are also used in 3G tablets, and pressure sensors and MEMS microphones likewise will join the fray in 2011. All this will result in the expansion of MEMS sales in tablets and help drive the growth of the overall market for MEMS consumer electronics devices and mobile devices."

The consumer electronics and mobile market for MEMS in 2011 will grow by more than 25%. This will nearly equal the growth rate of 2010, when the industry recovered robustly following the economic crisis of 2009.

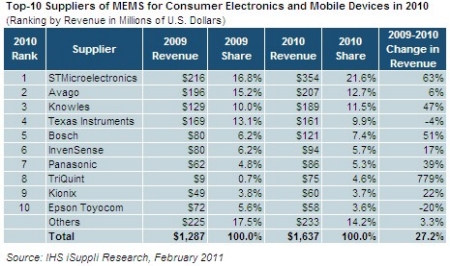

Revenue in 2011 for MEMS sensors and actuators used in various consumer and mobile devices — including cell phones and tablets — will reach $2.07 billion, up 26.2% from $1.64 billion last year. The growth will continue the 27.1% expansion of 2010 after the market retreated to single-digit growth in 2009 given the economic slowdown. The five-year market prospects call for growth by a factor of nearly three to $3.71 billion in 2014, up from $1.13 billion in 2009, translating into a solid compound annual growth rate (CAGR) of 23.6% during the time period.

Among consumer and mobile devices, cell phones will command the largest share of MEMS use in 2011, projected to reach $1.1 billion. Cell phone sales will continue to expand during in the years to come, and both conventional handsets as well as smart phones will employ an ever-larger number of MEMS devices.

Video gaming, while still the second-largest application for consumer MEMS this year at $229.7 million, is on a path of steady decline because of market saturation and declining prices for MEMS devices for the sector. Revenue will rebound in 2014 when next-generation gaming platforms are introduced, breathing new life into the segment.

Other important markets for consumer MEMS in 2011 are cameras, projectors, laptops, MP3 players and televisions.

Top MEMS devices

Utilized in devices like mobile phones and tablets but also in gaming, cameras, laptops and remote controls, accelerometers this year will continue to hold the pole position among all consumer MEMS devices. Revenue from accelerometers in 2011 will exceed $500 million, with cell phones accounting for the majority of accelerometer shipments from now until at least 2014.

Catching up fast to accelerometers are 3-axis gyroscopes, in second place this year with revenue also in excess of $500 million, thanks to their use in the iPhone 4 from Apple and the PlayStation Move game controller from Sony Corp as well as in handheld game players, e.g. the Nintendo 3DS and the new PSP from Sony. By 2014, accelerometers and gyroscopes will figure in a neck-and-neck finish, with the combined market for both devices reaching a market-commanding $1.6 billion.

Other best-selling MEMS devices in 2011 will include bulk acoustic wave filters, which will benefit from the increasingly widespread use of next-generation 4G wireless technology; MEMS microphones, predominant in noise-suppression technology made popular by the Droid smart phone from Motorola Corp as well as the iPhone 4; and digital light processing (DLP) chipsets, currently enjoying a renaissance with the advent of tiny pico projectors.

Read "Consumer MEMS: The Sky is the Limit!" at http://isuppli.com/MEMS-and-Sensors/Pages/Consumer-MEMS-The-Sky-is-the-Limit.aspx?PRX

IHS iSuppli technology value chain research and advisory services range from electronic component research to device-specific application market forecasts, from teardown analysis to consumer electronics market trends and analysis and from display device and systems research to automotive telematics, navigation and safety systems research. More information is available at www.isuppli.com. IHS (NYSE: IHS) is a source of information and insight in energy, economics, geopolitical risk, sustainability and supply chain management.

Follow Small Times on Twitter.com by clicking www.twitter.com/smalltimes. Or join our Facebook group