February 22, 2011 — "From $847M in 2009, the motion sensor market will reach $2.56B in 2015," says Laurent Robin, market and technology analyst at Yole Développement. The firm’s new report analyzes the motion sensor value chain and infrastructure & players for consumer business.

|

|

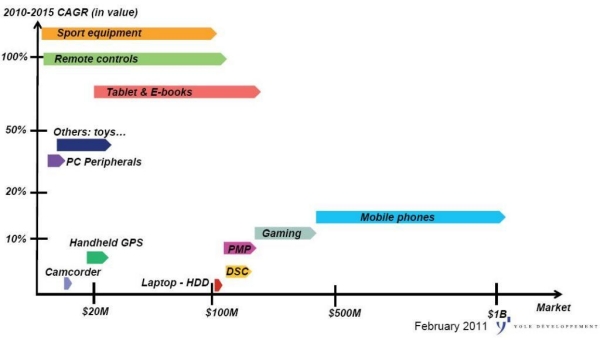

Arrows show market size evolution from 2010 to 2015. |

| Figure. 2010-2015 market trends for motion sensors: Accelerometers, gyroscopes, and compass for consumer and mobile applications. SOURCE: Motion Sensors for Consumer & Mobile Applications Report, 2011, Yole. |

In this report, Yole Développement provides an application focus on key existing markets and promising emerging ones for motion sensing electronics: new features, technical roadmap, insight about future technology trends & challenges. This study includes market data on motion sensors for consumer & mobile products: key market metrics & dynamics.

The inertial sensor market for consumer electronics is growing very quickly due to the fast adoption of accelerometers, gyroscopes and magnetometers in mobile phones, tablets, game stations and laptops. 20.3% annual growth is expected: from $847M in 2009, the motion sensor market will reach $2.56B in 2015.

The MEMS accelerometer market will show lucrative business opportunities in coming years. This market will be strategic because many applications are expected to rely on 3-axis accelerometer + 3-axis gyroscope in a single package within 2015. There is a strong synergy between accelerometer and gyroscope technologies and players.

The gyroscope market is thriving thanks to the successful introduction of 3-axis devices by ST Micro and InvenSense. While adoption in handsets is only starting to surge, (with iPhone since June 2010 and now with Android smartphones) the gaming market is quickly growing and additional markets are emerging like tablets or remote controls.

Compasses are also gaining strong market traction. 2010 was an incredible year for digital compass in handsets, but the market will find growth outside of the mobile phone area as well: on gaming, on DSC for advanced geo-tagging, etc. It will be particularly interesting to monitor strategies of newcomers to compete against AKM, which is way ahead in the market. Competition is gaining in intensity as the motion sensing market becomes increasingly attractive. More than 50 companies are targeting this business including large players and small companies. But in the consumer market, only a few companies are really making money out of this business, while the others are struggling to make a decent profit.

Competition:

There is competition among companies trying to offer a complete product family (accelerometers, gyroscopes and magnetometers), either internally or with partners (ST is partnering with Honeywell for example on electronic compass).

|

Companies cited in the report:

|

Competition among devices: accelerometer, gyroscopes and electronic compass can provide functions, either alone or in combination with each other. So companies have to propose the best sensor or sensor combination for a dedicated function.

Competing business models: fabless companies (InvenSense for example) are competing against integrated device manufacturers (ST, Kionix, Panasonic, Epson Toyocom, Freescale). Optimization of the production cost is one of the biggest key success factors. It is thus necessary for all players to work hard in order to really get the costs lower and produce on 8" wafer lines at a reasonable yield.

Hardware competing against software: companies such as Movea start to impact the traditional supply chain model by bringing a novel expertise in software and sensor fusion.

Technology competition: companies are proposing discrete devices (a 3-axis accelerometer, a 3-axis gyroscope, etc.) or sensor combination (acceleration sensor plus gyroscope, gyroscope plus electronic compass, etc.) either in a system-in-package or on a single die, along with a transition from a sensor offer to a solution offer (with sensor fusion).

Which company, business model, device will win? Motion sensing is both a booming and fragmented market, so multiple companies can have an important part of the business. Cost-effective production infrastructure is clearly important but as the market will be moving from device to functions, the software and "function delivery" part of the business will be more and more significant.

This area is exciting and still far from being mature. "We expect considerable evolutions in the next years as illustrated by the strong demand for more precise and long-term navigation solutions, including indoor pedestrian navigation," explains Laurent Robin. In parallel to the current race to develop ultra-low cost versions of motions sensors, few start-ups are working on revolutionary motion sensing technologies by using different sensing principle or different way of combining motion sensors, with compatibility to a low-cost production infrastructure.

Laurent Robin is in charge of the MEMS & Sensors market research at Yole Développement. He previously worked at image sensor company e2v Technologies (Grenoble, France) and at EM Microelectronics (Switzerland). He holds a Physics Engineering degree from the National Institute of Applied Sciences in Toulouse. He was also granted a Master Degree in Technology & Innovation Management from EM Lyon Business School, France.

Yole Développement is a group of companies providing market research, technology analysis, strategy consulting, media in addition to fi nance services. With a solid focus on emerging applications using silicon and/or micro manufacturing Yole Développement group has expanded to include more than 40 associates worldwide covering MEMS and Microfluidics, Advanced Packaging, Compound Semiconductors, Power Electronics, LED, and Photovoltaic. More information on www.yole.fr

Follow Small Times on Twitter.com by clicking www.twitter.com/smalltimes. Or join our Facebook group