April 11, 2011 — Yole Développement’s new report, "Flip-Chip: Technologies, Applications, Market report – April 2011" will be available at the end of April.

The report aims to provide an understanding of the new requirements and technologies that will reshape the supply chain of the world’s highest value package platform, flip chip.

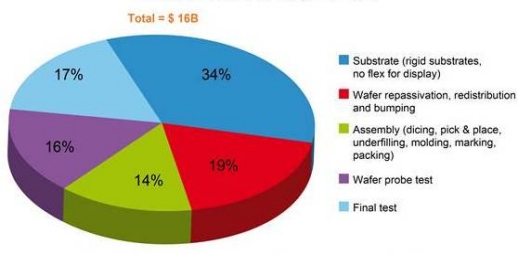

Flip-chip packages accounted for 13% of all integrated circuit (IC) packages by the end of 2010, but accounted for over 29% of the global IC assembly, packaging, and test market. Flip chip is a $16 billion market, and while it looks to be a large and mature packaging sector, Yole’s analysts argue that it is still in its growth phase, with major technology and application and supply chain transformations looming ahead.

|

| 2010 total flip chip market value. Split by cost-of-ownership supply chain segments (substrates for LCD drivers excluded, service margin included). SOURCE: Flip Chip report, Yole Développement, April 2011. |

Renewed interest in flip-chip technologies is motivated by the rising cost of gold used for wire bonding, the need for thinner devices, continued CMOS downscaling, higher currents and temperatures, and lower voltages.

Mobile applications are increasingly requiring footprint and weight reduction coupled with higher electrical performance (signal propagation and power distribution) that excludes wire bonded packages. The emergence of the 28nm CMOS technology node in particular poses new quality and reliability constraints on interconnect technologies, due to fragility, which may disqualify wire bonding. Increasing I/O density neccessitates new bumping

|

Companies cited in the report:

|

and substrate technologies.

Flip-chip technologies and applications are diverse, with different drivers, levels of maturity, and sometimes alternative technologies. Flip-chip applies to a number of different applications addressing different packaging forms. To some, flip-chip applies to large digital system-on-chip (SOC) devices like microprocessors, graphical processor units or chipsets for personal computers and gaming stations. Flip-chip applies not only to packages but also to interconnection of bare integrated circuits, like the display drivers found around all LCD screens worldwide; and flip-chip packages can address devices with die sizes ranging from less than 1mm2 up to the maximum die sizes (around 650mm2).

The flip-chip market is undergoing major technology and supply chain transformations: emerging copper (Cu) pillar popularity, technology investments, changes to the supply chain, the role of CMOS foundries in flip chip packaging, and substrate cost/value. The Yole report describes their impacts on the semiconductor industry for the coming 5 years.

Key report highlights include the 2010 market status of wafer bumping for flip-chip, flip-chip package substrates, flip-chip underfills with breakdown of market data by player, player profile, region; Supply chain analysis and ranking of the wafer bumping, flip-chip substrate and underfills players; 2010 market status and 2011-2016 forecasts with breakdown by application area, IC type, bumping metallurgy in wafer counts and package units; the application fields of flip chips; copper pillar bumping status and developments; and more.

Access the report at http://www.i-micronews.com/reports/Flip-Chip/200/

Subscribe to Solid State Technology/Advanced Packaging.

Follow Advanced Packaging on Twitter.com by clicking www.twitter.com/advpackaging. Or join our Facebook group