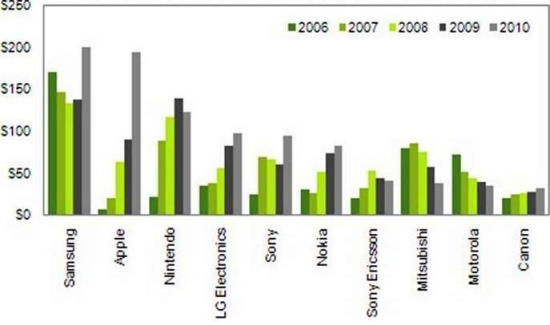

April 28, 2011 — Samsung Electronics Co. in 2010 recaptured the top spot from Nintendo Co. as the largest buyer of microelectromechanical system (MEMS) sensors for mobile phones and other consumer electronics like tablets, while Apple Inc. grabbed second place to move within striking distance of number 1, according to new research from Jérémie Bouchaud of IHS iSuppli.

The finalized rankings show that Samsung last year bought approximately $200 million worth of MEMS sensors, which went mostly to its mobile handsets, a considerable increase from $137 million that the company spent in 2009. Also the top spender for consumer and mobile MEMS in 2008, Samsung finished as runner-up in 2009, muscled out by Nintendo.

Jumping from third to second spot was Apple, not far behind Samsung with $195 million in spending. For its part, Nintendo fell to third with $125 million after a brief stay at the top in 2009. LG Electronics remained at fourth with $97 million, followed by Sony Corp. moving into fifth with $95 million.

Rounding out the top 10, in descending order:

- Nokia Corp. with $83 million;

- Sony Ericsson with $41 million;

- Mitsubishi Electric with $38 million;

- Motorola Inc. with $35 million;

- And Canon Inc. with $32 million.

|

|

Figure. Top consumer and mobile MEMS purchasers (millions of USD). SOURCE: IHS iSuppli April 2011. |

Four companies on the list had lower MEMS expenditures in 2010 than in 2009:

- Mitsubishi suffered the biggest drop at 33.3%;

- Nintendo with 11.5%;

- Motorola with 10.3%;

- Sony Ericsson with 4.7%.

The consumer and mobile MEMS segment is the largest sector of a broad, sprawling MEMS industry, which also boasts of thriving individual markets for wired communications, industrial, military and civil aerospace, automotive and data processing.

As the top buyer of consumer and mobile MEMS, Samsung’s shopping bag included bulk acoustic wave (BAW) filters from Avago Technologies and TriQuint Semiconductor, followed by accelerometers from Bosch Sensortec, Kionix and STMicroelectronics, according to information provided by IHS iSuppli’s Teardown Service.

Other important MEMS items purchased by Samsung last year included microphones from Knowles Electronics, gyroscopes from STMicroelectronics, and digital light processing (DLP) chips for pico projectors from Texas Instruments.

Apple proved to have the highest growth in consumer and mobile MEMS expenditures, up 116.7% from $90 million in 2009. The MEMS sensors bought by Apple last year included 3-axis gyroscopes from STMicroelectronics for the iPhone 4, iPod Touch, and — toward the end of 2010 — the iPad 2 tablet. Apple also bought accelerometers for the above three devices as well as for the iPod Nano and MacBook computer. In addition, BAW duplexers came from TriQuint for the iPhone and iPad 3G; while Analog Devices Inc., Knowles and AAC Inc. (using die from Infineon Technologies) provided Apple with MEMS microphones for the iPod Nano 5th Generation, iPhone 4 and Apple headsets and the iPad 2.

Apple is responsible for creating new MEMS markets for consumer electronics and handsets far beyond its own consumption, IHS believes. The first iPhone made it popular for handsets to use accelerometers — devices that provide auto-screen rotation and gesture-based command functions — and was a market worth $304 million in 2010. The iPhone 4 also employed gaming-style gyroscopes, a $49 million market in 2010 that will jump to more than $100 in handsets. Likewise, the MEMS industry owes a tremendous debt of gratitude to Apple for single-handedly reviving the tablet, a hotbed for MEMS projected to be worth more than $200 million by 2015.

Nintendo’s third-spot finish this year was marked by the company’s MEMS expenditures on single- and dual-axis gyroscopes from InvenSense, intended for both the Wii Motion Plus remote controller as well as for Nintendo’s newly released 3DS handheld device featuring 3-D gaming. Nintendo also bought single-axis gyroscopes from Epson Toyocom, as well as accelerometers from STMicroelectronics and Bosch Sensortec for the Wii and 3DS.

LG Electronics, staying put in fourth place this year, purchased MEMS mostly for its handsets. The company also obtained BAW filters from Avago; microphones from Knowles; accelerometers from Bosch Sensortec, Kionix, Freescale Semiconductor and STMicroelectronics; and toward the end of the year 3-axis gyroscopes from InvenSense and STMicroelectronics.

Sony’s one step move up from sixth place in 2009 placed it second, after Apple, in yearly MEMS expenditure growth, up 55.8% from $61 million in 2009. Sony bought gyroscopes as the company’s highest spend, sourced from various players and fitted to the Sony Move remote controller for the PlayStation 3 game console.

Suppliers to Sony included STMicroelectronics for single-, dual and 3-axis gyroscopes; Sony itself for the dual-axis version; and Murata, Epson Toyocom and STMicroelectronics for the single-axis gyroscope in the Dualshock controller for the PlayStation 3. Accelerometers also were needed for the Sony Move and Dualshock from Kionix, with STMicroelectronics serving as a second source.

Learn more at http://www.isuppli.com/MEMS-and-Sensors/Pages/Consumer-MEMS-The-Sky-is-the-Limit.aspx?MWX

Follow Small Times on Twitter.com by clicking www.twitter.com/smalltimes. Or join our Facebook group