April 7, 2011 – Five years after losing its leadership position in global MEMS supplies, Texas Instruments is back on top thanks to demand for digital light processing (DLP) technology, according to IHS iSuppli’s new 2010 rankings. (Check out 2009 results here and here.)

|

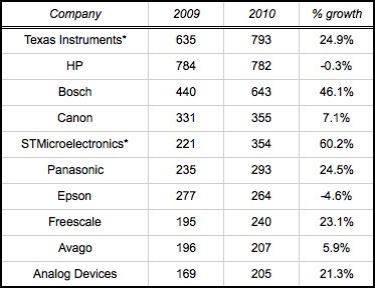

| Top 10 MEMS IDM and fabless manufacturers in 2010 (in US $M). *Does not include MEMS foundry revenue. (Source: IHS iSuppli) |

"Texas Instruments’ fortunes in the MEMS market have risen and fallen based on the success of its DLP technology," said Jérémie Bouchaud, director and principal analyst MEMS and sensors for IHS, in a statement. Before 2005 it rode popularity of DLP for rear-projection TV sets, but once those started disappearing so did DLP demand and pricing — its sales slumped 31% from 2005-2009.

Now DLP demand is rising again with the emergence of front-projectors and pico projectors, particularly in China and India, thanks in part to its ability to project 3D content (helps in education applications). Meanwhile, pico projectors produce large displays for their diminutive size (<2lb and <60in3), some of which tan put up 50-in. diagonal images on surfaces (e.g. a wall) using the DLP technology — perfect for advanced mobile devices such as smartphones and netbooks. (A million DLP pico projectors shipped in 2010, iSuppli notes.)

And so, TI enjoyed nearly 25% growth in 2010, third best among the top-10, raking in $793M worth of MEMS. HP’s sales actually declined a fraction to $782M.

A quick snapshot of the other top-10 players:

Hewlett-Packard: The now-No. 2 MEMS chipmaker stagnated due to weakness in the inkjet printhead sector, which contracted -0.8%. HP’s shipments were up, but sales were down due to price erosion, but also HP’s gradual switch to permanent parts, which dented its installed base for disposable print nozzles.

The Bosch Group: The company maintained its No.3 spot and leadership in the sensor segment of MEMS, as sales spiked 46% in 2010. Its consumer MEMS sales (Bosch Sensortec) grew even better (51% to $120M) thanks to accelerometers used in cell phones, in which it outpaced all competitors (ADI 30%, Kionix 22%, ST 10%). Meanwhile, Bosch’s sales growth in auto MEMS outraced the overall sector (45% vs. 32%), due to a rapid rebound in car production, more demand for luxury cars and sensor-equipped cars in Germany, Chinese demand for manifold air pressure sensors, and new government mandates for auto safety systems.

STMicroelectronics: The fastest-growing of the big MEMS suppliers (60%) is tops in the rapidly expanding markets for consumer electronics and cellphone MEMS, notes iSuppli. The company has shipped 50% of consumer accelerometer demand in the past two years (meaning it won’t be able to gain much share anymore), and is seeking new growth drivers e.g. in gyroscopes, which brought in $117M in 2010 and represented 85% of the company’s revenue growth in consumer MEMS. MEMS microphones and MEMS pressure sensors for handsets and tablets should contribute to revenue in 2011, iSuppli notes. Meanwhile, ST also is now shipping low-g accelerometers and introducing high-g accelerometers for airbags.

Learn more in IHS iSuppli’s MEMS website: http://isuppli.com/MEMS-and-Sensors/Pages/Products.aspx

Follow Small Times on Twitter.com by clicking www.twitter.com/smalltimes. Or join our Facebook group