Vincent Gu, IHS iSuppli

June 6, 2011 — China’s fabless semiconductor market will see high growth from growing exports, doubling its revenue from 2010 to 2015, according to IHS iSuppli research.

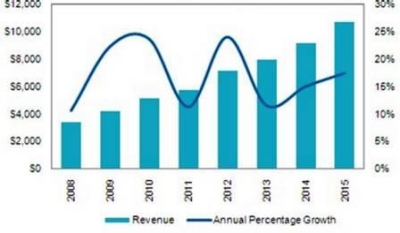

Operations by fabless semiconductor companies in China will generate $5.74 billion in revenue in 2011, up from $5.2 billion in 2010 and $4.2 billion in 2009. 2015 will see revenues at $10.7 billion, predicts IHS iSuppli.

|

| Figure. Chinese fabless IC industry revenues (USD millions). Source: IHS iSuppli May 2011. |

Cell phone IC demand benefited China’s fabless companies in 2010. Mobile handsets designed in China saw a nearly 60% shipment rise last year. Chinese fabless supplier Spreadtrum Communications designed a range of semiconductors for cell phones including core chipsets, radio frequency (RF) transceivers and total wireless solutions. The company posted $346 million in revenue in 2010, making it the first fabless semiconductor supplier in the country to surpass the $300 million mark. Spreadtrum is likely to retain leadership in 2011 with revenue of more than $500 million.

The new C3 — China, consumer, and convergence — will carry China’s fabless semiconductor companies to growth in the future:

China. Although most fabless companies are based in the US, fabless firms have a "home advantage" in China, with vast domestic demand and fully capable domestic production facilities.

Consumer electronics. Chinese chip designers are on the same wavelength with consumer electronics technology, price and quality expectations.

Feature convergence. Smartphones and tablets are wildly sucessful in part because of features convergence. This integration is changing the IC industry and traditional chip business models, which the Chinese fabless suppliers must be aware of for continued growth.

More Cs: Culture, content, contribution. China’s fabless companies must accommodate and adjust to the differing cultures of overseas customers, much like US and European companies have had to adjust to China’s culture in outsourcing relationships. China’s fabless providers will need to understand end-content sectors that drive technology growth. Finally, they would do well to take advantage of government contributions to the fabless industry, given that Beijing has instituted a range of policies to improve the fabless industry in areas including investments, favorable tax rates and capital investments. China’s government launched a new policy this year on the software and integrated circuit (IC) industry. The new policy is more flexible, and the Chinese fabless industry appears set on a fast track to growth in the future.

Another C: Challenges. The fabless industry in China has had trouble penetrating the logic semiconductor market.

In the first half of 2010, both foundry and assembly capacity were in a state of short supply, and capacity was often out of reach given the small size of domestic fabless suppliers.

A small group of large companies dominate the semiconductor industry. Small fabless Chinese fabless companies therefore are handicapped when competing with "giants" in the industry, notes IHS iSuppli.

Read IHS iSuppli’s China electronics analysis at http://www.isuppli.com/China-Electronics-Supply-Chain/Pages/Product-Research.aspx?q1=7

Also read: 13 fabless IC suppliers in 2010 $1b sales club, says IC Insights

Subscribe to Solid State Technology/Advanced Packaging.

Follow Solid State Technology on Twitter.com via editors Pete Singer, twitter.com/PetesTweetsPW and Debra Vogler, twitter.com/dvogler_PV_semi.