April 15, 2011 – Intel and Micron have pushed the NAND flash pin a little farther down the road, introducing a 20nm version of an 8GB multilevel cell device. The 118mm2 device provides ~50% more GB capacity with "similar performance and endurance" as the 25nm version, and reduces up to 40% board space (depending on package design). The 20nm 8GB device is now sampling with a planned production ramp in 2H11 in the second half of 2011, at which point they’ll start sampling a 16GB version. (That would mean up to 128GB of capacity in a single postage-stamp-sized solid-state storage device.)

More than a year ago IM Flash disclosed its 25nm multilevel NAND flash device, and showed it off at December’s IEDM, giving a standing-room-only crowd a peek under the hood. It’s been a one-upmanship battle with Toshiba/SanDisk, which in August 2010 showed a 24nm NAND flash 8GB chip (promising 32Gb and 3bit/cell versions), and days ago debuted a 24nm version of its SmartNAND embedded memory.

Analyst take

Micron’s 20nm shrink has been disclosed for a couple of months, and without the fanfare of its 25nm announcement, notes Objective Analysis’ Jim Handy. But there are numerous reasons why this really is a big deal:

- It further extends the conventional floating-gate process, where the rest of the industry have been prepping a changeover to charge-trapping. A few years ago (~2003) Intel like others doubted that NAND flash could scale past the 60nm node, "and that the industry would have to move to some new technology like PCM, RRAM, MRAM, or something else," Handy says — and now we’re "a full four process nodes beyond that point."

- No other semiconductor technology is being manufactured using 20nm process technology, by anyone, for any type of chip. "Neither Intel Nor Micron made a big deal out of this, yet it is quite a big deal," says Handy. "Just as IMFT moved to 25nm while its competitors were phasing in their 35nm designs, the JV will now be phasing in 20nm while competition is transitioning into 25nm."

- Manufacturing costs for the 20nm NAND should be around $0.33/GB at production volumes — vs. ~$0.50/GB for the 25nm part, and just under $1/GB for the 34nm devices. That’s a nice margin for NAND flash memory that’s currently selling for ~$1/GB, Handy notes. And if industry watchers are correct, a NAND flash oversupply is coming later this year which will send prices lower, so IMFT’s move to a lower cost structure will pay off.

- IMFT’s "aggressive stance" is more than a technological achievement — it’s also a psychological play, sending the message to the market that they’ll stay in the lead and thwart other NAND chip suppliers, Handy suggests. "Why would OEMs buy a low-endurance part from a competitor when they can purchase standard-endurance parts from Intel and Micron?" (SanDisk might be an exception since it also sells cards and USB drives, he notes.)

|

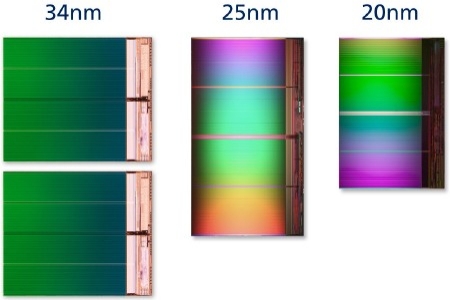

| Comparison of two 32Gb IM Flash 34nm die, vs. one 64Gb (8GB) die on 25nm and new 20nm processes. (Source: Intel/Micron) |