(August 5, 2010) — IDTechEx announced "RFID Forecasts, Players & Opportunities 2011-2021," which shows RFID as a $5.63 billion market in 2010.

In 2010 the value of the entire RFID market will be $5.63 billion, up from $5.03 billion in 2009. This includes tags, readers and software/services for RFID cards, labels, fobs and all other form factors. $3.27 billion of the total $5.63 billion is spent on non-car-like structures: from RFID labels to active tags.

|

|

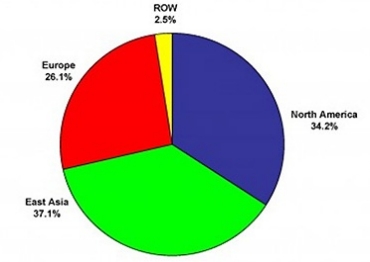

Figure. Total RFID market by territory 2011-2021 (2016 data shown). Source: IDTechEx 2010. |

Which sectors are booming and which are under performing? This report examines each sector in turn. Those doing well in numbers sold are sometimes much less impressive in dollars taken and vice versa. Highly profitable ‘niche’ markets are analyzed. Major players now and in the future in the various parts of the value chain are identified and the big orders and milestones now and in the future are analysed. Of course, not everyone will want to serve the severely price constrained, highest volume markets are also considered. For them, IDTechEx examines many niches of at least one billion dollars potential that are emerging and many smaller opportunities where there is even less competition. They include: Passports in the face of new terrorism resulting in new laws; Livestock and food traceability in the face of new laws, bioterrorism, avian flu, BSE, fraud with subsidies etc.; Intermodal containers (Smart and Secure Tradelanes and other initiatives); Retail apparel; Healthcare; Those in prison and on parole; Ubiquitous Sensor Networks (USN), for warning of natural disasters, military and other purposes.

In retail, RFID is seeing rapid growth for apparel tagging; that application alone demands 300 million RFID labels in 2010. RFID in the form of tickets used for transit will demand 380 million tags in 2010. The tagging of animals (such as pigs, sheep and pets) is now substantial as it becomes a legal requirement in many more territories, with 178 million tags being used for this sector in 2010. This is happening in regions such as China and Australasia. In total, 2.31 billion tags will be sold in 2010 versus 1.98 billion in 2009. Most of that growth is from passive UHF RFID labels.

|

Follow Advanced Packaging on Twitter.com by clicking www.twitter.com/advpackaging. Or join our Facebook group |

Analysis is broken out by market, including in-depth historic data. Over 200 companies are profiled in this report. We give detailed ten year forecasts of the volumes of tags required, their value and the total market value for the following market segments: Passive RFID: Drugs, Other Healthcare, Retail apparel, Consumer goods, Tires, Postal, Books, Manufacturing parts/tools, Archiving (documents/samples), Military, Retail CPG Pallet/case, Smart cards/payment key fobs, Smart tickets, Air baggage, Conveyances/Rollcages/ULD/Totes, Animals/Livestock, Vehicles, People (excluding other sectors), Passport page/secure documents, Other tag applications and Active RFID/battery-assisted: Pharma/Healthcare, Cold retail supply chain, Consumer goods, Postal, Manufacturing parts, tools, Archiving (samples), Military, Retail CPG Pallet/case, Shelf Edge Labels, Conveyances/Rollcages/ULD/Totes, Vehicles, People (excluding other sectors), Car clickers, Other tag applications. RFID is a growing market for MEMS devices.

RFID revenues are given separately by application type for 2005 to 2021, for both active and passive tags. Forecasts have taken into account the global economic slow down. Looking at the range of applications, the biggest projects, which tend to be government led are usually profitable for suppliers involved. For example, governments mandate tagging passports or cattle. Governments do not need a fast return on investment. In industry, RFID is being applied where it can demonstrate a fairly rapid return on investment.

Analysis includes detailed ten-year projections for EPC vs non-EPC, high-value niche markets, active vs passive, readers, standards, markets by frequency, markets by geographical region, label vs non label, chip vs chipless, markets by application, tag format and tag location. Cumulative sales of RFID are analyzed as are the major players and unmet opportunities. It covers the emergence of new products, legal and demand pressures and impediments for the years to come.

The report results from extensive research including interviews with RFID adopters and solution providers in the various applicational RFID markets, giving insight into the total RFID industry and what is really happening. Purchasers receive an electronic PDF and (optional) printed copy of this report, a separate functional spreadsheet of the forecasts, and access to report updates throughout the year. Learn more at www.IDTechEx.com/forecast

Read more about RFID from Bernie Meyerson, IBM, keynote of SEMICON West: http://www.electroiq.com/index/display/semiconductors-article-display/0001729661/articles/solid-state-technology/semiconductors/industry-news/business-news/2010/july/ibm_s-meyerson__finding.html