(September 3, 2010) — SEMI Europe Grenoble Office announced that 10 semiconductor equipment and product providers will present their latest technologies at SEMICON Taiwan, September 8-10, in the French Pavilion.

The pavilion is organized by UBI France in close collaboration with SEMI Europe Grenoble Office, as well as the worldwide competitive cluster MINALOGIC, which is devoted to IC design and fabrication and associated embedded software. Most of the exhibiting companies and organizations have co-development programs on 3D applications with CEA-Leti. The National Research Institute is co-exhibiting at SEMICON Taiwan to help them promote their products and services.

French exhibitors include:

CEA-Leti

CEA is a French research and technology public organization, with activities in four main areas: energy, information technologies, healthcare technologies and defense and security. Within CEA, the Laboratory for Electronics & Information Technology (CEA-Leti) works with companies to increase their competitiveness through technological innovation and transfers. CEA-Leti is focused on micro- and nanotechnologies and their applications, from wireless devices and systems, to biology and healthcare or photonics. Nanoelectronics and microsystems (MEMS) are at the core of its activities. As a major player in MINATEC campus, CEA-Leti operates 8,000-m² state-of-the-art clean rooms, on 24/7 mode, on 200mm and 300mm wafer standards. With 1,200 employees, CEA-Leti trains more than 150 Ph.D. students and hosts 200 assignees from partner companies. Strongly committed to the creation of value for the industry, CEA-Leti puts a strong emphasis on intellectual property and owns more than 1,500 patent families. www.leti.fr. Get all the latest research information from CEA-Leti in these interviews with SST senior technical editor Debra Vogler: Research updates on EUV, mask, cleaning, etc from Leti

FOGALE nanotech

FOGALE nanotech, a globally recognized reference in the field of high accuracy dimensional metrology, is introducing MEMSCAN, the first inspection and metrology solution fully dedicated to MEMS manufacturing. Developed in partnership with MEMS manufacturers, MEMSCAN fits perfectly with MEMS manufacturing requirements for surface micromachining and wafer-level packaging process control. Both metrology and IR inspection are performed in one shot with one tool. www.fogale.fr/~fogaleco/pages/home.php Fogale launched a North American initiative in 2007.

IBS

IBS recently introduced PULSION, the next-generation of plasma immersion ion implanter (PIII). Its unique polarization mode and pulsed-plasma configuration, using dual region chamber (CR) technology, delivers process stability, ultra-low energy and high throughput for advanced memory and logic applications. These applications include ultra-shallow junctions, without energy contamination; thin dielectric modification, nano- precipitates synthesis, hydrogen implantation, trench doping or conformal doping, and solar cells. IBS is partnering with Axcelis to deliver world-class support for PULSION. www.ion-beam-services.com/

LCP’S Consultants

LCP’S Consultants is a company created in 1996 to support SMEs, large enterprises and other organizations in establishing and following up on R&D projects. They concentrate on microelectronics, and micro- and nanotechnologies both for manufacturing and applications.

Presto Engineering

Presto helps IDMs and fabless customers improve new device predictability and speed to market by complementing their internal resources with comprehensive chip test and analysis. Supported by unique technical skills and extensive industry experience, Presto’s product-engineering services include RF and 3D integration and state-of-the-art ATE, reliability testing, failure analysis and fault isolation. www.presto-eng.com. Presto recently partnered with WIN to offer GaAs testing services.

Riber

Riber develops and manufactures molecular beam epitaxy (MBE) systems and evaporation sources and cells essential for manufacturing compound semiconductor materials used in numerous industrial, scientific and consumer applications, including new information technologies, OLED screens and new-generation solar cells. The company’s MPVD 300 offers all the benefits of the molecular beam deposition technology: atomic control, abrupt interfaces and low thermal budget for silicon-based novel devices. MPVD 300 also allows an innovative solution for introducing new materials and developing new structures to further improve CMOS-based Si devices. www.riber.com/ Riber has partnered with researchers at IMEC on Ge and III-V semiconductor work.

SET

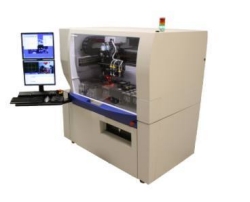

Smart Equipment Technology is a world-leading supplier of high-accuracy die-to-die, die-to-wafer bonding and nanoimprint lithography (NIL) solutions. Its FC300 High Force Device Bonder is a new generation of high-accuracy and high-force system for populating wafers up to 300 mm. The FC300 features automated handling of chips and substrates up to 100mm from waffle packs, plus a robotic option that enables chip picking from diced wafers and automated handling of larger substrates. SET has developed a substrate chuck and a bond head with localized confinement that operates safely with reducing gases such as forming gas or formic acid vapor. This configuration has been successfully implemented on SET bonder models FC150 and FC300, especially in the case of chip-to wafer bonding applications. www.set-sas.fr/en/index.xml Smart Equipment Technology has collaborated with IMEC on 3D packaging

Satin Technologies

Formerly known as Satin IP Technologies, Satin Technologies delivers software solutions for fact-based, design-quality monitoring and closure. Working within customers’ design flows, the company’s VIP Lane® turns customers’ design practices (for IP blocks, SoCs, embedded systems) into a robust and reliable set of quality criteria and metrics. These customer-based parameters are used to create automated, sharable dashboards and quality compliance reports. By providing an alternative to manually filled, time-consuming checklists and documents, VIP Lane delivers effective flow integration and on-the-fly quality monitoring at no overhead to design teams. www.satin-tech.com

FantastIC Sourcing

FantastIC Sourcing is a distributor and sourcing specialist of electronic components multi- brands focused on quality, cost efficiency and rapidity. Our team has provided service and expertise for more than a decade to OEMs, contract manufacturers, and industry majors around the world, as well as dynamic domestic actors, producers of consumer goods, wireless, telecommunication, automotive, robotics, computer, aerospace and medical assembled electronic systems. Our mission is to offer to our customer the best quality, service and products in the shortest lead time to prevent supply chain disruption. www.fantast-ic.com.

UBIFRANCE

UBIFRANCE, the French agency for international business development, comes under the aegis of France’s Ministry for the Economy, Industry & Employment. UBIFRANCE lies at the heart of France’s public-sector export support framework. With 64 Trade Commissions in 44 countries, UBIFRANCE offers a comprehensive range of products and services aimed at accompanying French-based companies in their development on export markets. www.ubifrance.com/

SEMI Europe Grenoble Office is the new association merging JEMI France and SEMI. Learn more at www.semi.org/eu

Global competitive cluster Minalogic fosters research-led innovation in intelligent miniaturized products and solutions for industry. For more information, visit www.minalogic.org

Die Bonder, created for flexibility, high accuracy and precision.

Die Bonder, created for flexibility, high accuracy and precision.