September 21, 2009 – The latest numbers on North American and Japanese semiconductor equipment demand suggest continued growth and recovery, though levels are still low and analysts see a long climb back to normalcy.

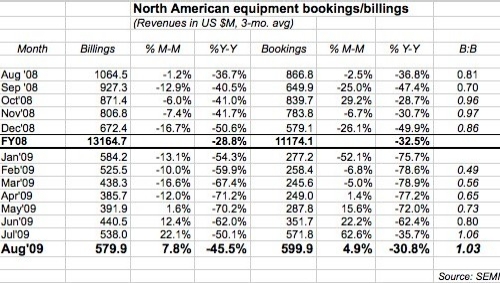

Worldwide bookings in North America came in at just under $600M in August 2009, a 5% improvement from July. Billings were about $580M, up nearly 8% from the prior month. And for both sides, yearly comparisons continue to improve, albeit slowly (bookings -31%, billings -45%), but far better than they were earlier in the year. And the book-to-bill ratio (B:B) held above the 1.0 parity mark at 1.03, meaning $103 worth of orders came in for every $100 worth of product billed for the month

Some quick highlights:

- Back-to-back parity in the B:B, not seen in close to three years (Dec.06-Jan.07)

- Bookings growth: Five straight months of M/M growth, not seen since spring of 2006 (February-June)

- Billings growth: Four positive M/M months, not since spring of ’07 (March-June)

Yearly comparisons are still ugly, but are now generally back in the same ballpark as they were in late 2008, the beginning of this mess — which suggests improvements will continue.

Equipment bookings have increased for five straight months and equipment sales are in the black for four straight; device sales and fab capacity utilization also have been improving, noted Stanley Myers, SEMI president/CEO, in a statement. And seeing the B:B ratio above the 1.0 parity mark for a second straight month generally indicates more business coming in than going out.

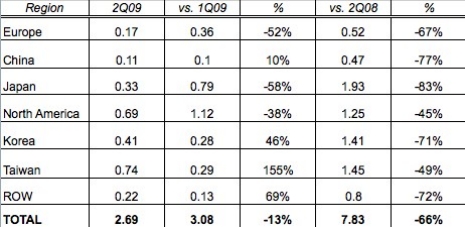

Another macro-sign of improvement: for the full quarter (2Q09) bookings/orders spiked 83% from 1Q09 to $2.95B; worldwide sales (which by definition trail bookings trends) were down only about -13% vs. the prior quarter to $2.69B. (Compared with 2Q08, bookings were down -58% and billings -66%, as if we needed reminding.) Such spending is comparable to what was seen in the early 1990s, noted SEMI’s Myers, in another statement.

And numbers are also brighter in Japan, where bookings (three-month moving average) rose about 27% from July to ¥55.46B (US ~$609M) and billings rose 17.6% to ¥38.57B ($423.6M). The Japanese B:B soared to 1.44 (vs. 1.34 in the prior month) to stay well above parity for the third straight month.

Positive growth is certainly better than the alternative, especially in this new era where thinking quarterly, rather than annually, seems to be the preferred way to identify trends and shifts (and elicits the most optimism). August growth was quite a bit lower than the previous few months but perhaps that can be attributed to end-of-summer/midquarter/post-West/ doldrums. (Or maybe, as some have suggested, it’s indicative of a slight pullback among devicemakers/foundries.)

Sustained growth is certainly good, but it’s only part of the story — it’s going to take a long, hard push to get the industry back to a level of normalcy that’s sustainable for the industry overall, and for individual companies struggling to stay alive and compete. Gartner’s recent industry forecast update shows the spending rebound will crest in 2012 at about $50.3B, well below 2007’s level of $63.3B. IC Insights last week suggested the industry is committing a historically unprecedented 12% of sales to capex, and will stay in the low teens through 2013. What will the industry landscape do in the face of another year (or several) of discomfort? Time will tell — and maybe sooner rather than later.