| Executive Overview

As the semiconductor industry continues to push for smaller chip footprints on larger wafers, it becomes even more important to be able to inspect wafers and detect defects as quickly as possible. The capabilities of advanced motion controllers can give OEMs a distinct advantage in being able to achieve these demands by centralizing all automation control. In this article we will discuss how semiconductor OEMs can increase performance and reduce costs by utilizing advanced motion control techniques and diagnostic tools that are available today. |

Cameron Sheikholeslami, ACS Motion Control, Eden Prairie, MN, USA

An OEM of high precision electron beam wafer inspection machines recently identified three core needs in their next generation machine: 1) High-resolution position feedback, 2 Extremely tight position standstill and constant velocity jitter, and 3) The ability to easily interface with both Windows and Unix-based PCs.

Cost constraints and the requirement for minimum time to market led this OEM to choose a control system solution composed of standard off-the-shelf components, configured specifically to meet the application needs.

The OEM’s need for extremely high-resolution position feedback devices was crucial. Previous generation machines had been utilizing standard linear encoders, however, these devices are limited in their accuracy for resolving position. For example, a 20µm linear scale analog encoder with 12-bit resolution can only be resolved to around 4.88nm. Linear encoders are also buried inside a position stage, which means that while they accurately detect the position of the motor, they introduce an error when the goal is to know the position of the load. This error is negligible for many applications, but relative to the accuracy requirements of the OEM, it can quite large.

Laser inferometer feedback

To address these issues, the OEM decided to use laser interferometer feedback devices on the next-generation machine. Laser interferometers are the ultimate feedback devices for high-precision motion control applications because of their ability to determine position with extremely high resolution. In this application, a He-Ne laser with a wavelength of 632nm was used with 12-bit resolution that is accurate to around 0.04nm. Also, they can measure the position directly at the load, which removes a source of error that the linear encoders introduced.

Certain limitations of the laser interferometers cannot be avoided. One limitation is that the interferometers are strictly incremental devices with no "home" reference point, which can cause problems in zeroing the machine. A second limitation is that while measuring the position at the load increases accuracy, it also reduces servo bandwidth and stability, especially with stages that are not very stiff. This is because the structure resonances have a phase lead characteristic when the feedback is close to the motor (which can be easily tuned), while the structure resonance has a phase lag characteristic when the feedback is close to the load, which is more difficult to tune. A Bode plot from an actual system is shown in Fig. 1 and depicts the different frequency response when the laser feedback and encoder are used (plotted in a dashed and bold line, respectively).

|

Figure 1. Bode plot of a laser interferometer depicting the different frequency response for when the laser feedback and encoder are used. |

The motor commutation is not as accurate for the same reason. A third limitation is more cost related, but relates to the mirrors. Shorter mirrors reduce cost, but they also reduce the total range of travel. In the same regard, it is also easy to block the laser beam and lose feedback, which is problematic if the motor is moving fast and friction is low, as disabling the axis may cause the motor to run into the hard stops.

|

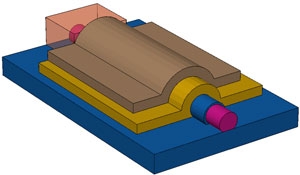

Figure 2. A dual feedback scheme using laser interferometers and linear encoders. |

To get all the benefits of the laser interferometer without suffering from the limitations, the OEM ultimately decided on using a dual feedback scheme that employed both the laser interferometers and the linear encoders (Fig. 2). The MC4U is designed such that the OEM was able to run the machine in single-loop mode with the encoder feedback, single-loop mode with the laser interferometer feedback, and dual-loop mode with the laser interferometer providing the position feedback, and the encoder providing the velocity feedback (all modes use the linear encoder for commutation). Also, on-the-fly switching allows the user to switch between modes at any time, even if the motor is in motion.

There is no issue with homing because the linear encoder index is sufficiently accurate and repeatable to set the reference position for both the linear encoder and laser interferometer. The advanced tuning tools available from the MC4U address the tuning difficulty, and the ability to change the tuning parameters on the fly allows for an easy transition between the different feedback modes. There is no issue with motor commutation because it is always updated using the linear encoder. The short travel range and safety issue that could occur if the laser beam is blocked is addressed by the on-the-fly switching of the feedback so that if the motor moves beyond the travel range or if the controller loses the interferometer feedback because of a beam block, it simply reverts to the single loop mode using the linear encoder.

|

Figure 3. A comparison of performance when using encoder feedback vs. the laser interferometer feedback. After 0.27s, the feedback source is changed from the encoder to the laser interferometer. The plot shows the stage position error while at standstill, with the y-axis units of 10nm per division. |

A comparison of the performance when using the encoder feedback versus the laser interferometer feedback can be seen in Fig. 3. This figure is a plot of the stage position error while at standstill, with the y-axis units of 10nm per division. At the beginning of the plot, only the encoder feedback is used, which gives reasonable position jitter of around +/- 20nm. Around 0.3s into the plot, the on-the-fly switching from single-loop encoder mode to single-loop laser interferometer mode is activated and the position jitter significantly reduces to <+/- 5nm.

The tuning tools used by the OEM included the frequency response function (FRF) analyzer, a tool that generates a Bode plot representation of the system response. This powerful tool allows the OEM to accurately determine the electro-mechanical signature of the system (i.e. transfer function), which enabled them to put in appropriate filters to handle the phase lead / phase lag resonances introduced by the location of the feedback device.

Advanced motion control systems can help enable automated wafer transport systems to streamline a semiconductor manufacturer’s production and increase the capacity of fabrication lines. Often these systems employ specially-designed robots with minimal weight and footprint, traveling on a linear translation stage to transport wafers from one location to another.

- Typically, the main design challenges of a control solution for such systems are:

- Real-time kinematic calculations. The coordinate system of the moving motors is different from that of the moving wafer. The controller needs to calculate in real time the complex equations that translate the required movement of the wafer to the movement of the motors.

- Minimizing cabling of the moving robot arms while keeping weight at a minimum.

- Scalability: the ability to add axes and I/Os without affecting the basic solution.

For systems with such constraints, a fully-integrated controller topology is not ideal because of the many long, heavy cables required to connect the motors to the integrated controller and drive chassis. Long motor cables are especially susceptible to EMI noise and can significantly degrade overall control performance. Instead, a fast EtherCAT network topology (other networks, such as CANOPEN or DeviceNet, cannot meet the required network communication throughput) with a small form factor master controller housed in the main control chassis and small lightweight drives placed directly on the moving robot, provides an optimal solution. The only cable required between the master controller and the slave drives is the EtherCAT communication cable, which is not sensitive to EMI and is insignificant in terms of weight and drag to the moving system. This solution is also scalable, making it simple to add additional axes of drives or I/O modules for various models of the transport machines.

Conclusion

The recession has placed significant cost constraints on the entire IC fabrication process, placing the onus on OEMs to cut costs on inspection equipment while still exceeding the performance capabilities of previous generation machines. The capabilities of advanced motion controllers enable OEMs to centralize all automation control and achieve high-performance requirements. Motion control systems not only provide semiconductor OEMs with increased performance, but they can also reduce costs by utilizing off-the-shelf components as well as advanced motion control techniques and diagnostic tools.

Biography

Cameron Sheikholeslami received his bachelor’s in electrical engineering and biomedical engineering from the U. of Minnesota, Twin Cities, and is a control and applications engineer at ACS Motion Control, Inc., 6575 City West Parkway, Eden Prairie, MN 55344 USA; ph.: 763-559-7669, x132; email [email protected].

More Solid State Technology Current Issue Articles

More Solid State Technology Archives Issue Articles

In an exclusive series of blogs, imec reports from its International Technology Forum (ITF) last week in Brussels. Els Parton, science editor, imec, shares Jy Bhardwaj’s (Philips Lumileds) points about LEDs costs improvements.

In an exclusive series of blogs, imec reports from its International Technology Forum (ITF) last week in Brussels. Els Parton, science editor, imec, shares Jy Bhardwaj’s (Philips Lumileds) points about LEDs costs improvements.  May 24, 2011 – BUSINESS WIRE — GT Solar International Inc. (

May 24, 2011 – BUSINESS WIRE — GT Solar International Inc. (