October 19, 2009 – Now that everyone’s had their spin on Intel’s generally upbeat quarter, let’s boil it down to a few key bullet points:

– Growth and profits. Sales, profit margins, and earnings were all well beyond expectations: Sales were $9.4B, vs. Street’s $9.0B; net income $1.9B/EPS $0.33, vs. Street’s $0.28. And gross margins were 57.6% vs. 50.8% in 2Q, attributed in part to savings from reusing 45nm capacity for its new 32nm manufacturing. For 4Q Intel sees sales rising to $10.1B, and gross margins rising to 62%.

"Gross margins stole the show," writes Broadpoint AmTech Research’s Doug Freedman, which "reflect impressive MPU and chipset shipments and minimal mix impact from strong Atom sales." Intel execs and analysts generally agreed that the norm for margins should be somewhat less than 60%, though. Craig Berger with FBR Capital Markets wrote that he is "encouraged" by tangible benefits from "leaner factory headcount, improving production cycle-times, and more equipment reuse between process nodes (including 32nm). Intel probably could ramp revenues to $11.5B if demand calls for it, and net profit could surge to EPS $0.56, he added.

– Demand. Corporate spending is still weak, but Intel execs are confident that an upgrade cycle is approaching for the fleet of aging business technology. And the trend of lower-end "netbooks" is still going strong and helping the bottom line, because the chips use trailing-edge technology and have great profit margins. It’s still the core PC market that drives the industry train, though, and Otellini said he "wouldn’t argue" with projections of 10% (or more) PC unit growth in 2010, and that Intel likely wouldn’t exceeded that growth.

Related to the foreseen corporate spending refresh is the timeliness of the anticipated Windows 7. Otellini noted that despite "a lot of excitement about" Windows 7 there seems to have had not much impact on the purchasing climate, but that there is "a lot of interest" around Windows 7 and Intel’s new Nehalem-based SKUs; he sees evals happening through this year and purchases on a refresh basis in 2010.

– Inventories. Related to demand is the persistent question whether inventories are being rebuilt in anticipation of, rather than direct response to, rebounding demand — if it’s the former, the industry could find itself with a backlog to work down at the beginning of 2010, which would dent and delay hopes for a chip industry recovery.

Intel execs, though, says things are well-positioned on the stocking front:

[CEO Paul Otellini]: We watched supply chain inventory very carefully and believe the pipeline has been appropriately rebuilt to support increased end demand and yet remains well below the peak we saw at the end of 2008.

[CFO Stacy Smith]: From an internal inventory standpoint, we’re lower than I like right now. We want to get some inventory in place in Q4. Part of that is we’re just running a little leaner. We were surprised by some of the unit upsides we saw over the course of the third quarter and we want to replenish.

(Smith added later that he wants to "grow inventories modestly" in 4Q09.

– Capex. With one quarter remaining in its fiscal year, Intel tweaked its forecast for 2010 capital spending down to $4.5B, about $200M below previous estimates. The company tends to reinvest more intensely in downturns and had generally been expected to lag behind the rest of the industry with capex in the coming quarters, so few really noticed or cared. Cowen’s Raj Seth calls it a "minor negative" overshadowed by the bigger picture of an anticipated 30%-40%+ rebound in overall industry capex.

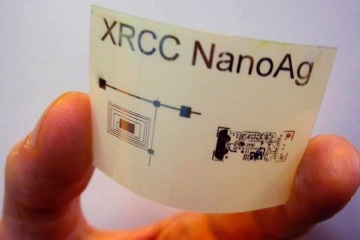

"For years, there’s been a global race to find a low-cost way to manufacture plastic circuits," said Paul Smith, laboratory manager at Xerox Research Centre of Canada, in a statement. "We’ve found the silver bullet that could make things like electronic clothing and inexpensive games a reality today," and enable capability for low-cost printed electronics on a wide scale of materials.

"For years, there’s been a global race to find a low-cost way to manufacture plastic circuits," said Paul Smith, laboratory manager at Xerox Research Centre of Canada, in a statement. "We’ve found the silver bullet that could make things like electronic clothing and inexpensive games a reality today," and enable capability for low-cost printed electronics on a wide scale of materials.